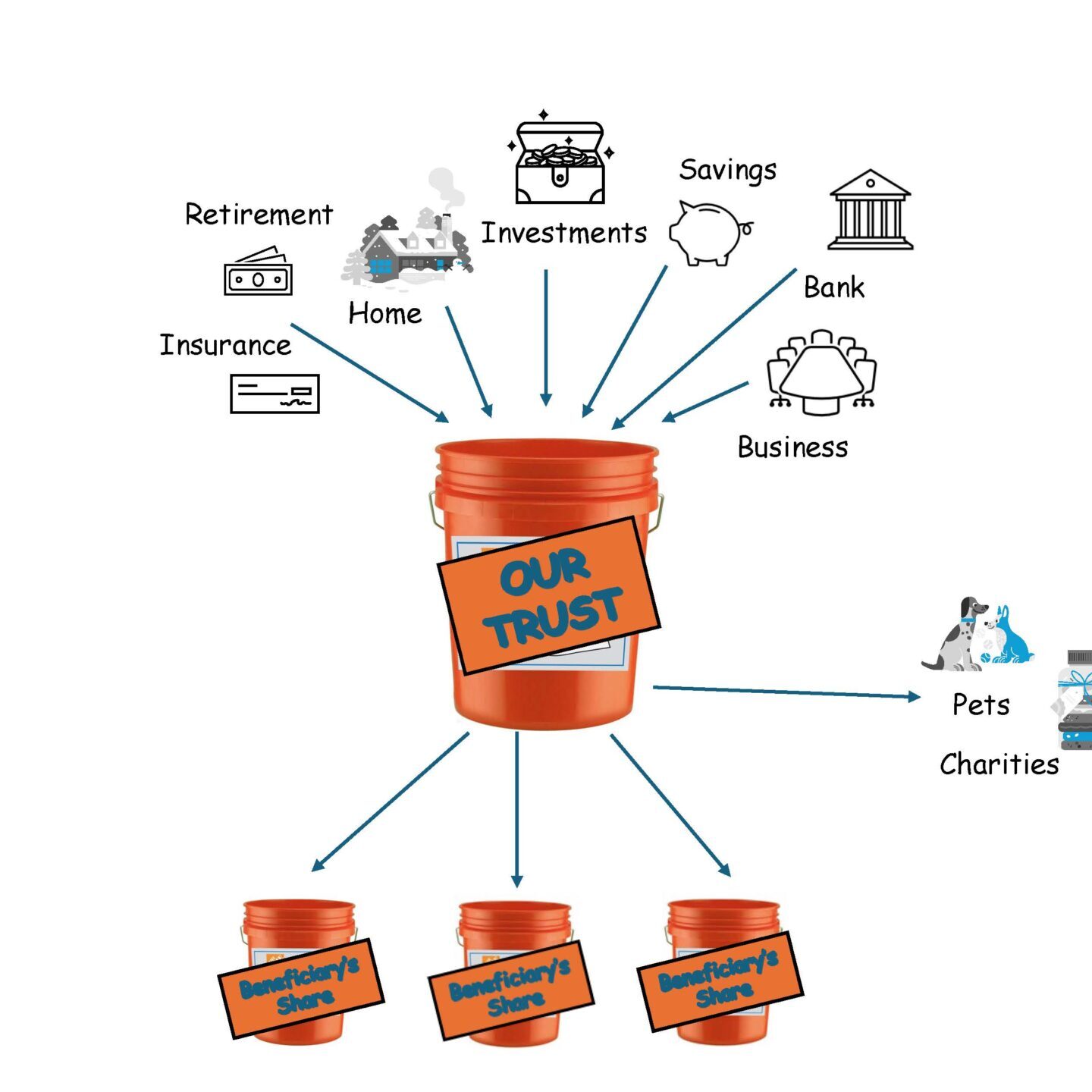

Trusts and Your Estate Plan

How We Can Help

We help create your Wills, Trusts and and comprehensive Estate Planning solutions tailored to your specific needs and goals. Our dedicated team is here to support you in developing personalized Living Wills, Powers of Attorney, Health Care Directives, and robust Estate Plans.

You're Unique, So Your Plan Should Be Too.

We listen carefully to what you need. We work closely with you to create a strategy that effectively protects your assets and ensures the future well-being of your family. With our guidance, we can help you develop and maintain family privacy and fulfillment of your your wishes.

Effective Trusts & Estate Planning Services

A trust may offer you a variety of advantages, such as:

- Avoiding Probate

- Protecting Adult Children from their Potential Mistakes

- Minimizing or Avoiding Tax Consequences

- Keeping Financial Information Private

- Setting Money Aside for Your Children and Grand Children

- Setting Aside Money for Potential Disability or Long-Term Care

- Assisting with Supplemental Needs or Special Needs

- Obtaining Medicaid for yourself or a loved one

Types Of Trusts

- Revocable Living Trust

- Living Trust

- Joint Trust

- Spendthrift Trust

- Irrevocable Trust

- Medicaid Trust

- Land Trust

- Testamentary Trust

Are Estate Plans Necessary For Everybody?

Links and Resources

What You Need to Know About Transferring Your Season Tickets In many parts of the United States, football is more than just a sport—it’s a way of life and a passion shared across generations. While fans often pass down their love for an NFL or college football team to their family, transferring season tickets is…

Did you know that the majority of Americans do not have a will? It’s true! The number of US households with a will has been steadily declining. But estate planning isn’t just for the wealthy, older adults, or married couples; it’s beneficial for everyone. Let’s bust some common myths about wills and estate plans: Myth…

Last week, our associate attorney, Demi Lamas, Esq., had the opportunity to attend the Florida Council of Aging’s Annual Florida Conference on Aging in Orlando, Florida. During the event, Demi connected with a variety of professionals dedicated to supporting and caring for the elderly community across the state. We’re proud of Demi for representing our…

Our friend John has a job at Publix. He has a good job, a comfortable salary, and a nice home. However, John has never thought about what would happen if he lost his job or became ill or injured. One day, John is involved in a car accident and is unable to work for several…

When starting a new marriage, there is much to think about: communication, living conditions, holiday plans, financial stability, and the wedding itself. However, something often overlooked by new spouses is the importance of creating an estate plan. It can be hard to think about what would happen if your spouse became ill, incapacitated, or worse, but an estate plan can ease those difficult times. An estate plan typically includes a will or trust, but the most important documents for a new couple are Health Care Directives and Powers of Attorney.

Here are key lessons from the Lenos’ experience: 1. Spouses Can’t Automatically Step In: Many believe that being married means their spouse can automatically manage their finances or healthcare decisions if they become incapacitated. This isn’t true. After turning 18, no one, not even a spouse, can manage these affairs without prior consent (through estate planning documents) or court involvement.

Although television and movies are entertaining with their conflicts and cliffhangers, Real-life estate administration is less dramatic than Hollywood would have you believe

While finding the time during our busy lives may be challenging, having a well-thought-out and carefully drafted plan to protect our children is essential! Trusts offer a unique opportunity to leave a lasting impact on our children’s lives.

Many folks are not familiar with how estate tax works and whether they would have to pay inheritance taxes. Take my quiz to see how much you know. True or False: Estate or Inheritance Tax in Florida is higher than the national average. False.Thankfully, there is no state inheritance tax in Florida. True or False: If you…

Today, it is common for adults to be in long-term committed relationships but be unmarried. If you have a life partner and are unmarried, it is imperative that you have an estate plan if you want your partner to receive your money or property at your death or if you want them to make financial or medical decisions on your behalf if you are alive but unable to make your own decisions. If you rely on your state’s laws, an unmarried partner will likely receive nothing at your death and will have no authority to make decisions on your behalf.