Trusts and Your Estate Plan

How We Can Help

We help create your Wills, Trusts and and comprehensive Estate Planning solutions tailored to your specific needs and goals. Our dedicated team is here to support you in developing personalized Living Wills, Powers of Attorney, Health Care Directives, and robust Estate Plans.

You're Unique, So Your Plan Should Be Too.

We listen carefully to what you need. We work closely with you to create a strategy that effectively protects your assets and ensures the future well-being of your family. With our guidance, we can help you develop and maintain family privacy and fulfillment of your your wishes.

Effective Trusts & Estate Planning Services

A trust may offer you a variety of advantages, such as:

- Avoiding Probate

- Protecting Adult Children from their Potential Mistakes

- Minimizing or Avoiding Tax Consequences

- Keeping Financial Information Private

- Setting Money Aside for Your Children and Grand Children

- Setting Aside Money for Potential Disability or Long-Term Care

- Assisting with Supplemental Needs or Special Needs

- Obtaining Medicaid for yourself or a loved one

Types Of Trusts

- Revocable Living Trust

- Living Trust

- Joint Trust

- Spendthrift Trust

- Irrevocable Trust

- Medicaid Trust

- Land Trust

- Testamentary Trust

Are Estate Plans Necessary For Everybody?

Links and Resources

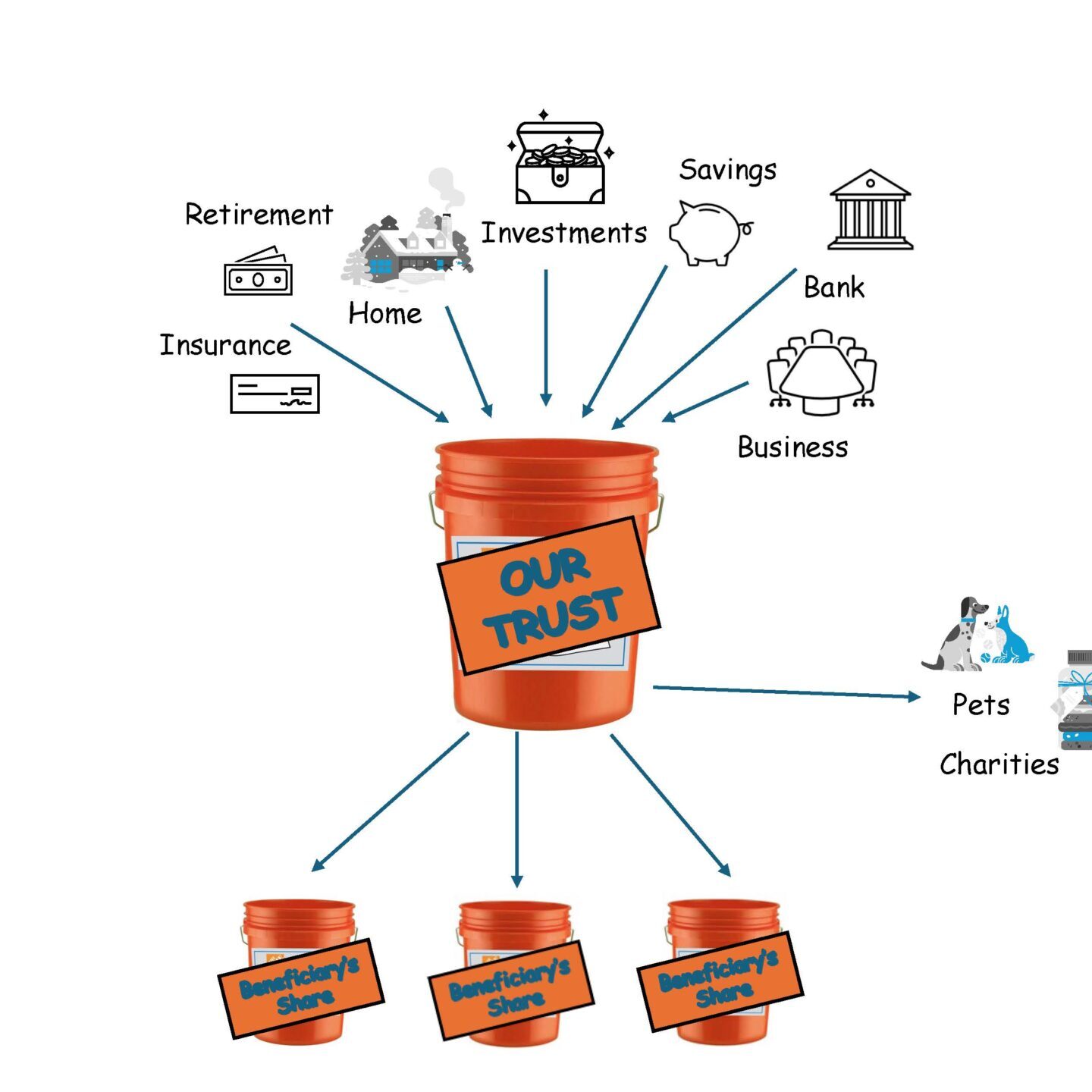

A trust is a legal document that can be created during a person’s lifetime and survive upon that person’s death. There are several types of trusts that can be established based upon that person’s needs or the needs of their surviving heirs. Understanding the different types of trusts and their uses may help you determine…

Contrary to popular belief, Estate Planning isn’t about who gets your stuff when you die. Yes, many times we often worry about what will happen to our assets and wonder who will get them. While this question is not fun to think about, it is an essential one to ask yourself at different points…

An “Estate Plan” contrary to popular belief, is not necessarily for those with mega millions. Anyone from an Uber driver to the Uber wealthy need to make sure those they love are able to access needed information if you are temporarily or permanently incapacitated or have passed.

Also called “Continuity Planning” our goal it to reduce any long-term risk for our businesses and family investments. Businesses should also consider business succession plans (what happens if the unthinkable happens) or simply planning for retirement as well.

Many people becoming trustees for the first time have asked questions such as “What is a trust?” or “What taxes must I pay as a trustee?” or “Am I required to file annual reports with a court?” Most people have had little experience with trusts.

As an attorney, I make sure that these mistakes do not occur. An online form is just a piece of paper, and if any mistakes are made, the family will feel it for years to come. Take a look at my post regarding POAs and the top 10 reasons you need an attorney to prepare one!

“Among the challenges are moments of joy.” Some of the terrific information contained in the site includes “life with Dementia”, Taking Action, Clinical Trials, Caregiver information, etc….

Alzheimers.gov is managed by the National Institute on Aging (NIA) at the National Institutes of Health (NIH)

Whether it’s guilting you into investing, instilling fear in you, or giving you the impression that they are professionals, con artists know exactly how to persuade you. Don’t rush yourself and don’t allow others to rush you. Take your time when making investment decisions, remain skeptical of unsolicited offers or offers that seem like they are too good to be true, and be sure that your money is always accessible.

There are several reasons why lawyers need to meet with your family member or friend alone for at least a part of the case evaluation process, so please don’t be alarmed or offended if you are asked to leave the room.

You should be proud of yourself for any degree of victory that you have accomplished during these times, it wasn’t easy!