Trusts and Your Estate Plan

How We Can Help

We help create your Wills, Trusts and and comprehensive Estate Planning solutions tailored to your specific needs and goals. Our dedicated team is here to support you in developing personalized Living Wills, Powers of Attorney, Health Care Directives, and robust Estate Plans.

You're Unique, So Your Plan Should Be Too.

We listen carefully to what you need. We work closely with you to create a strategy that effectively protects your assets and ensures the future well-being of your family. With our guidance, we can help you develop and maintain family privacy and fulfillment of your your wishes.

Effective Trusts & Estate Planning Services

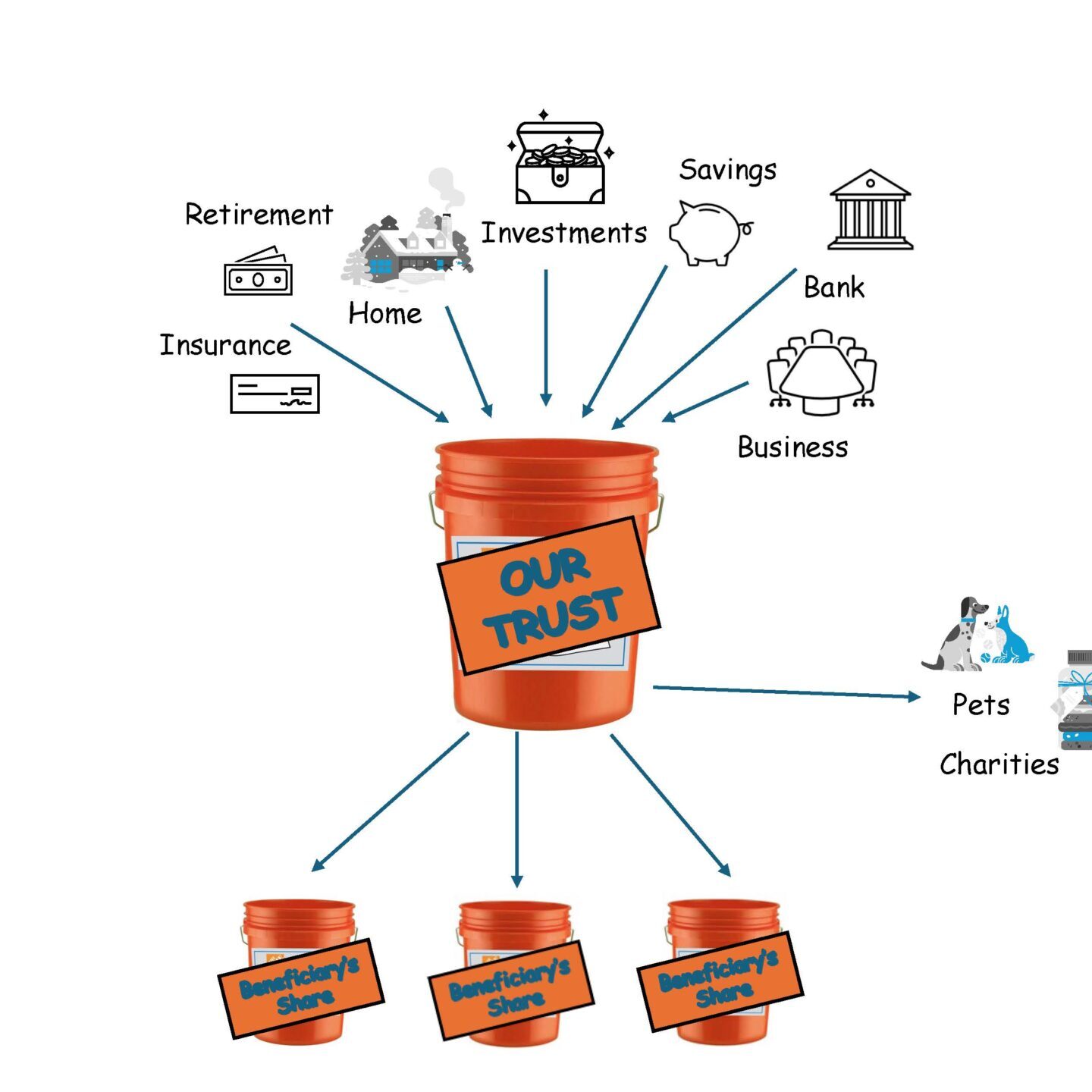

A trust may offer you a variety of advantages, such as:

- Avoiding Probate

- Protecting Adult Children from their Potential Mistakes

- Minimizing or Avoiding Tax Consequences

- Keeping Financial Information Private

- Setting Money Aside for Your Children and Grand Children

- Setting Aside Money for Potential Disability or Long-Term Care

- Assisting with Supplemental Needs or Special Needs

- Obtaining Medicaid for yourself or a loved one

Types Of Trusts

- Revocable Living Trust

- Living Trust

- Joint Trust

- Spendthrift Trust

- Irrevocable Trust

- Medicaid Trust

- Land Trust

- Testamentary Trust

Are Estate Plans Necessary For Everybody?

Links and Resources

As spring blossoms, it’s a perfect time to refresh and renew various aspects of your life, including your estate plan. You might be curious about using artificial intelligence (AI) or platforms such as Legal Zoom, Rocket Lawyer, Estate Plan templates or similar online services to write your plan. While “DIY Estate Plans” are accessible tools…

You might be surprised to learn that asset protection planning has been around for a long time, and you’ve likely already engaged in it. In fact, you probably have one or more traditional asset protection plans in place. However, these plans may not be enough to fully protect you and your family. What Is Asset…

A common misconception is that only wealthy individuals and people in high-risk professions, such as doctors or lawyers, need an asset protection plan. However, anyone can be sued. A car accident, foreclosure, unpaid medical bills, or an injured tenant can result in a monetary judgment that could crush your finances. What Is Asset Protection Planning?…

When beginning any type of planning, you usually start with some preliminary questions. Estate planning is no different. When you begin the process, your estate planning attorney will likely ask about your family members, the accounts and property you own, and whom you want to include in your estate plan. As you dive deeper into…

How to Pass Your Stories and Values to Future GenerationsMoney and property may be the most discussed types of wealth that a person owns, but theriches of their experience and wisdom can mean even more to loved ones down the line.Reinforcement of family traditions can be built into your estate plan alongside your wishesregarding the…

Valentine’s Day is a time to show love and affection. By preparing a will and other estate planning documents, you can ensure your loved ones are well taken care of now and in the future. Estate planning isn’t just about who gets what—it’s about ensuring your life’s work passes smoothly to those you love. Show your family your love by choosing what to include and what NOT to include in your estate plan!

New Year’s Eve Trivia and Fun Facts

Americans are known for their “work hard, play hard” mindset. On average, we work 1,789 hours per year. However, even with our play-hard mentality, many of us do not stay up to see the ball drop on New Year’s Eve. Less than one-third of Americans plan to either attend or host a New Year’s Eve…

Just like Santa makes a list of who’s naughty and nice, you can make a list of who should receive your money and property. The holidays are a great time to think about this while you’re with friends and family.

Fall is the perfect time to take stock of the past year and tie up loose ends before a frenetic last few weeks that can be equal parts stressful and celebratory. Read more to learn about having a fall to-do list can make the challenges of balancing family and professional commitments more manageable during this busy season.

Why has football captured the American imagination like nothing else? Some say football is a metaphor for life that can teach us lessons about discipline, teamwork, and overcoming adversity to reach a goal. Read more as we present to you your estate planning team, football-style.