Trusts and Your Estate Plan

How We Can Help

We help create your Wills, Trusts and and comprehensive Estate Planning solutions tailored to your specific needs and goals. Our dedicated team is here to support you in developing personalized Living Wills, Powers of Attorney, Health Care Directives, and robust Estate Plans.

You're Unique, So Your Plan Should Be Too.

We listen carefully to what you need. We work closely with you to create a strategy that effectively protects your assets and ensures the future well-being of your family. With our guidance, we can help you develop and maintain family privacy and fulfillment of your your wishes.

Effective Trusts & Estate Planning Services

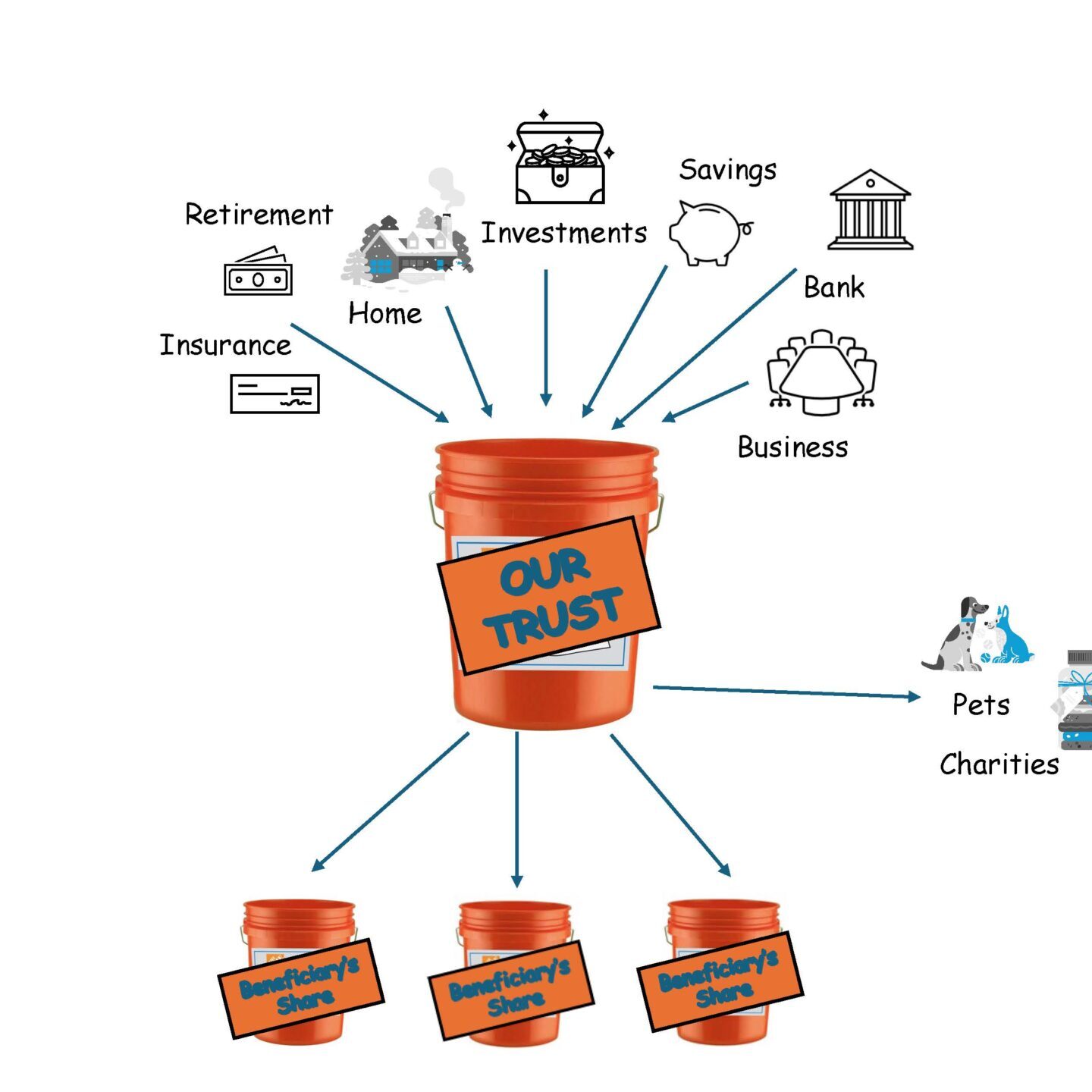

A trust may offer you a variety of advantages, such as:

- Avoiding Probate

- Protecting Adult Children from their Potential Mistakes

- Minimizing or Avoiding Tax Consequences

- Keeping Financial Information Private

- Setting Money Aside for Your Children and Grand Children

- Setting Aside Money for Potential Disability or Long-Term Care

- Assisting with Supplemental Needs or Special Needs

- Obtaining Medicaid for yourself or a loved one

Types Of Trusts

- Revocable Living Trust

- Living Trust

- Joint Trust

- Spendthrift Trust

- Irrevocable Trust

- Medicaid Trust

- Land Trust

- Testamentary Trust

Are Estate Plans Necessary For Everybody?

Links and Resources

While wills do not have expiration dates, certain changes can render them useless. When this happens, having an out-of-date will can be the same as having no will at all. It is important to review your will periodically to ensure it still does what you want. We examine five ways your will can become out-of-date

Business owners and entrepreneurs must use asset protection strategies to minimize risk to personal assets from creditor’s claims and litigation. Here a a few strategies to use to protect your assets!

Some exciting news that I want to share — we will be able to meet in our office- in person — very soon! I am still social distancing, so Zoom meetings and “Drive-By” signings are still available — but we are making progress!

The coronavirus pandemic caused the stock market to tumble, depleting many retirement accounts. RMDs for this year would be based on the value of the account at the end of 2019, when the account likely had more money in it because the stock market was at a high point. Although the market has rallied somewhat, it still isn’t back to where it was at the end of 2019.

Organize your wishes so your heirs don’t have undue stress.

Open to download my Ultimate Organizer PDF so that your family will have less stress during a very stressful time.

A DIY estate plan can lead to a false sense of security because it may not achieve what you think it does. If your DIY will is not valid, your property and money will go to heirs specified by state law—who may not be the people you would have chosen. An unfunded trust will be ineffective.

Will contests should be avoided at all costs. Not only can a contest derail your final wishes, but it can also rapidly deplete your estate and wreak emotional havoc on the family members left behind. Fear not. With proper planning, you can prevent that from happening.

While feeling healthy, individuals should plan ahead now and ensure that someone will take care of their financial duties by setting up a Financial Power of Attorney.

Preparing for Coronavirus: The #1 Legal Document Every Adult Needs to Have

As the coronavirus continues to disrupt daily life and leave Americans uncertain of the future, you don’t have to feel helpless during this pandemic. In fact, now is a great time to be proactive and plan ahead should you or a loved one fall ill. One of the most important and relatively easy things you can do (and should do) is to select a medical agent and set up your advance healthcare directive.

Medicaid recipients are wondering how the payment from the stimulus check will affect their eligibility.