Trusts and Your Estate Plan

How We Can Help

We help create your Wills, Trusts and and comprehensive Estate Planning solutions tailored to your specific needs and goals. Our dedicated team is here to support you in developing personalized Living Wills, Powers of Attorney, Health Care Directives, and robust Estate Plans.

You're Unique, So Your Plan Should Be Too.

We listen carefully to what you need. We work closely with you to create a strategy that effectively protects your assets and ensures the future well-being of your family. With our guidance, we can help you develop and maintain family privacy and fulfillment of your your wishes.

Effective Trusts & Estate Planning Services

A trust may offer you a variety of advantages, such as:

- Avoiding Probate

- Protecting Adult Children from their Potential Mistakes

- Minimizing or Avoiding Tax Consequences

- Keeping Financial Information Private

- Setting Money Aside for Your Children and Grand Children

- Setting Aside Money for Potential Disability or Long-Term Care

- Assisting with Supplemental Needs or Special Needs

- Obtaining Medicaid for yourself or a loved one

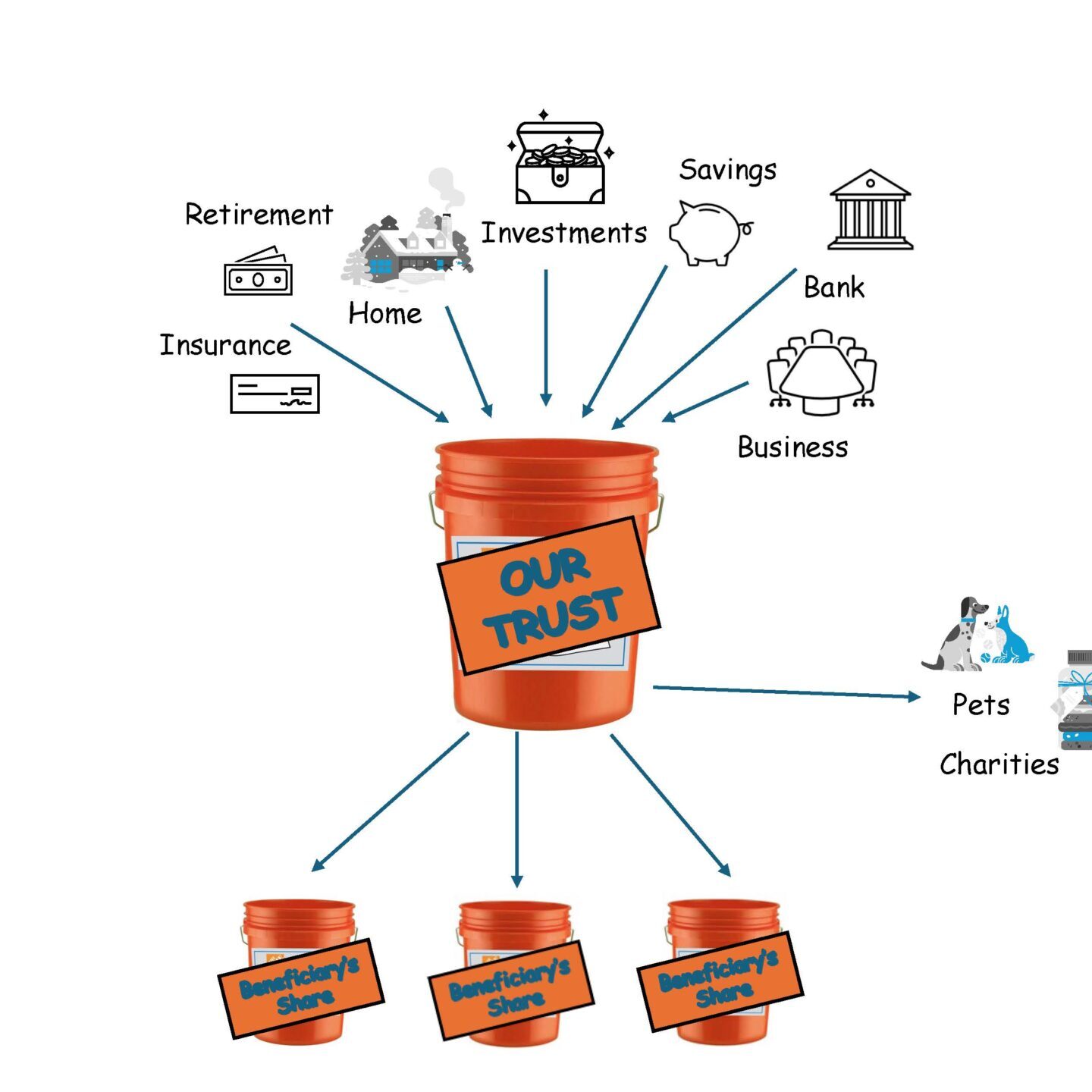

Types Of Trusts

- Revocable Living Trust

- Living Trust

- Joint Trust

- Spendthrift Trust

- Irrevocable Trust

- Medicaid Trust

- Land Trust

- Testamentary Trust

Are Estate Plans Necessary For Everybody?

Links and Resources

As one-child families become increasingly common in the U.S., many parents find themselves facing unique estate planning challenges. While having just one heir can simplify things, it can also create added pressure—both for parents making decisions and for the child who may inherit responsibilities along with assets. Why Only Child Estate Planning Is Different Gone…

Believe it or not, it is not easy to disinherit your spouse in the United States. In many states and the District of Columbia, you cannot intentionally disinherit your spouse unless your spouse agrees to receive nothing from your estate in a prenuptial, postnuptial, or other marital agreement. However, the same is not true for other family…

If your divorce is finalized, congratulations on making it through a tough chapter. But don’t stop there. One more step is crucial—talking to an estate planning attorney. Why? Because even if your divorce decree revokes some roles your ex held (like trustee or power of attorney), many things don’t change automatically. Your ex may still…

Running a business with your spouse can be incredibly rewarding—but let’s be honest, it’s not always easy. You live together, work together, and probably spend most of your free time together too. With that kind of closeness, it’s important to find balance, both personally and professionally. Here are a few practical tips to help your…

In honor of May’s flowers, Graduations and Mother’s Day, I’d love to share one of my favorite checklists for parents who have a new graduate in the family! The rules of parenting change completely once your child turns 18. They may still be financially dependent on you, but suddenly they are legally an adult in…

Is Outright Distribution the Perfect Fit for Your Loved Ones? Although Americans are living longer and spending more time—and money—in retirement, many parents intend to leave an inheritance to their children. The exact amount can vary greatly depending on individual circumstances and wealth levels, but even a small inheritance can be meaningful and help set…

Myths and Frequently Asked Questions: Planning for Conflict-Prone Families Myth 1: My spouse and I had our estate plan prepared 20 years ago. We don’t have to worry about anything until one of us passes away. Fact: Estate planning is not a one-and-done event. By not updating your estate plan to account for changes in…

Not Only for the Rich and Famous The term estate may bring to mind mansions, vast fortunes, and a level of wealth that many people do not possess. This misconception may lead to the false impression that estate planning is only for the rich and famous, discouraging those with more modest means from seeking professional…

Do you know which of your accounts have beneficiary designations, sometimes called transfer-on-death (TOD) or payable-on-death (POD) designations? Have you updated them recently? Are you aware of what can go wrong if there are issues with your beneficiary designation forms? If you answered “no” to any of these questions, read more to learn about the…