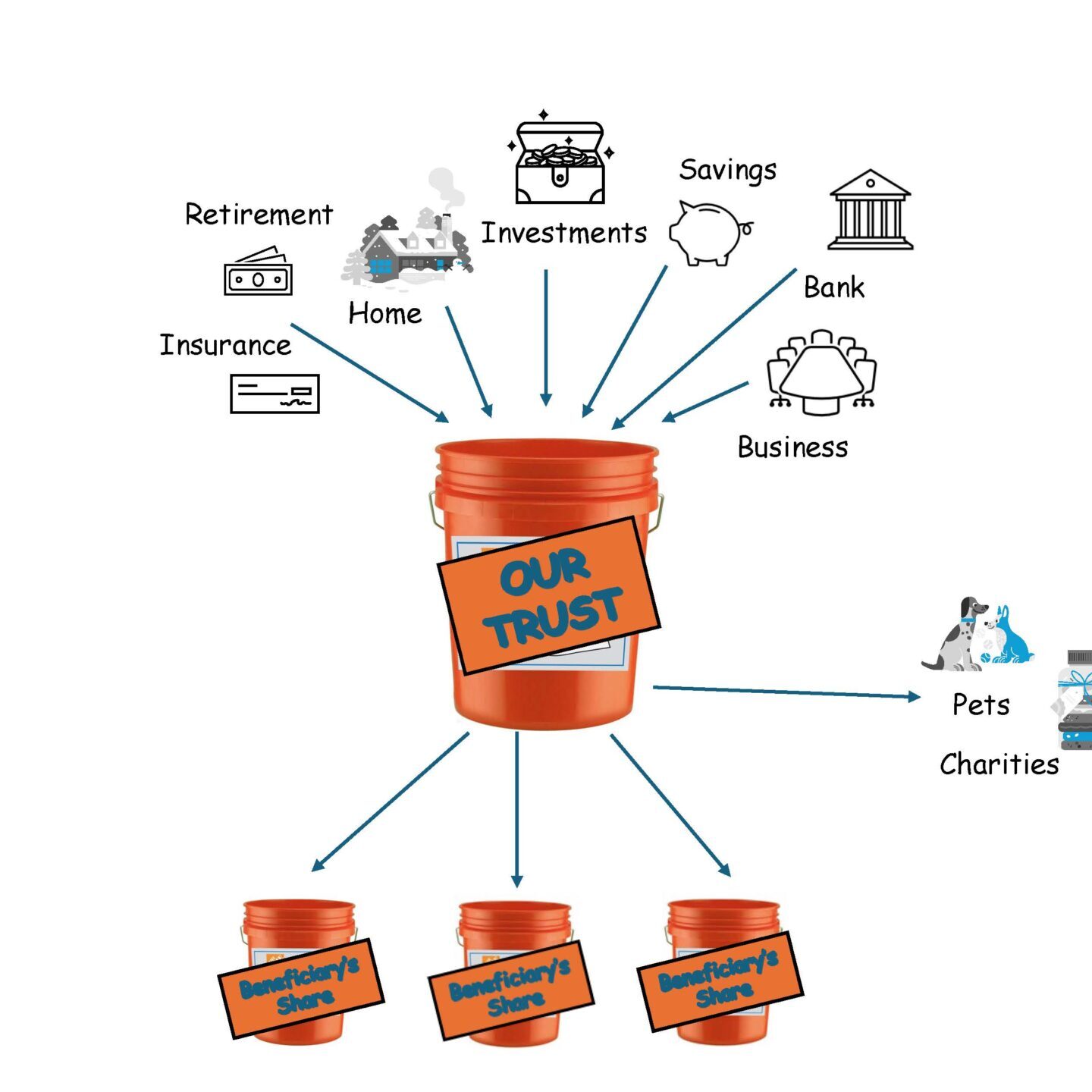

Trusts and Your Estate Plan

How We Can Help

We help create your Wills, Trusts and and comprehensive Estate Planning solutions tailored to your specific needs and goals. Our dedicated team is here to support you in developing personalized Living Wills, Powers of Attorney, Health Care Directives, and robust Estate Plans.

You're Unique, So Your Plan Should Be Too.

We listen carefully to what you need. We work closely with you to create a strategy that effectively protects your assets and ensures the future well-being of your family. With our guidance, we can help you develop and maintain family privacy and fulfillment of your your wishes.

Effective Trusts & Estate Planning Services

A trust may offer you a variety of advantages, such as:

- Avoiding Probate

- Protecting Adult Children from their Potential Mistakes

- Minimizing or Avoiding Tax Consequences

- Keeping Financial Information Private

- Setting Money Aside for Your Children and Grand Children

- Setting Aside Money for Potential Disability or Long-Term Care

- Assisting with Supplemental Needs or Special Needs

- Obtaining Medicaid for yourself or a loved one

Types Of Trusts

- Revocable Living Trust

- Living Trust

- Joint Trust

- Spendthrift Trust

- Irrevocable Trust

- Medicaid Trust

- Land Trust

- Testamentary Trust

Are Estate Plans Necessary For Everybody?

Links and Resources

Whether it’s an honor or a burden (or both), you have been appointed trustee of a trust. What responsibilities have been thrust upon you? How can you successfully carry them out? Here are nine do’s and one don’t to get you started: Do read the trust document. It sets out the rules under which you…

How frequently you should review your estate plan depends on how old you are and whether there has been a significant change in your circumstances. If you are over age 60 and you haven’t updated your estate plan in many decades, it’s almost certain that you need to update your documents. After that, you should…

How can you make sure your funeral and burial wishes will be carried out after you die? It is important to let your family know your desires and to put them in writing. Just don’t do it in your will. To help your loved ones follow your wishes after you are gone, you can write…

Many clients ask me what will be required of their “Personal Representative” or “Executor” when they pass away; and are concerned about their family members being required to undertake such a responsibility. Here is some information to pass along to their family and to hopefully shed light on the duties required by the position. A…

A durable power of attorney is an extremely important estate planning tool, even more important than a will in many cases. This crucial document allows a person you appoint — your “attorney-in-fact” or “agent” — to act in place of you — the “principal” — for financial purposes when and if you ever become incapacitated…

Having a loved one with dementia can be scary, but if you add in a firearm, it can also get dangerous. To prevent harm to both the individual with dementia and others, it is important to plan ahead for how to deal with any weapons. Research shows that 45 percent of all adults aged 65…

This is the last year that spouses who are turning full retirement age can choose whether to take spousal benefits or to take benefits on their own record. The strategy, used by some couples to maximize their benefits, will not be available to people turning full retirement age after 2019. The claiming strategy — sometimes…

Have you considered your pet or pets when planning your estate? If not, you should, according to The Humane Society of the United States, the nation’s largest animal protection organization. Pets usually have shorter life spans than humans, but people don’t always include their pets in their estate plans. If a pet owner doesn’t make…

The new tax law makes it harder to claim a tax deduction for charitable contributions. While charitable giving should not be only about getting a tax break, if you want to reap a tax benefit from your contributions, there are a couple of options. The Tax Cut and Jobs Act, enacted in December 2017, nearly…

The Social Security Administration has announced a 2.8 percent increase in benefits in 2019, the largest increase since 2012. The change will put an additional $468 annually in the pocket of the average retired beneficiary. Cost of living increases are tied to the consumer price index, and an upturn in inflation rates and gas prices…