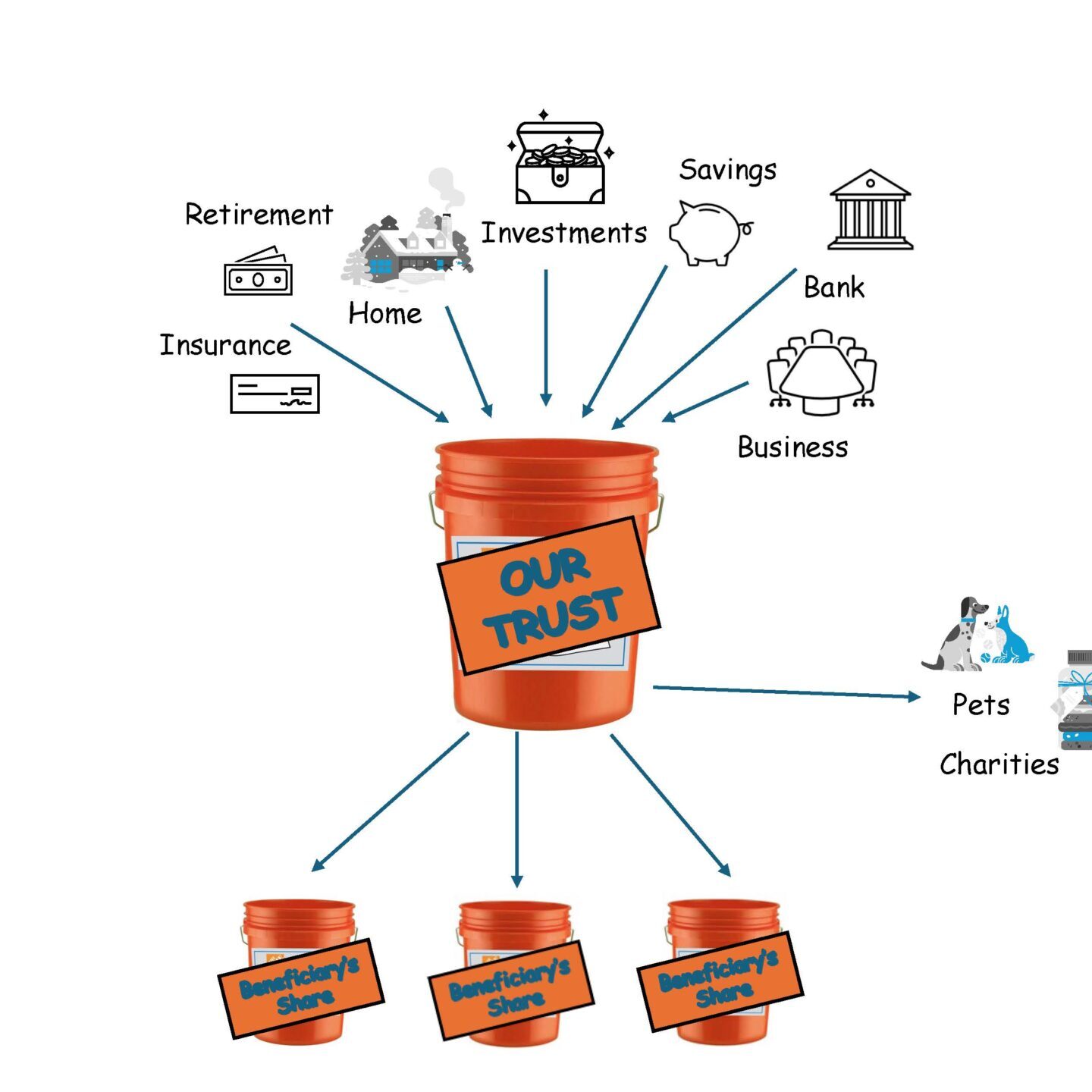

Trusts and Your Estate Plan

How We Can Help

We help create your Wills, Trusts and and comprehensive Estate Planning solutions tailored to your specific needs and goals. Our dedicated team is here to support you in developing personalized Living Wills, Powers of Attorney, Health Care Directives, and robust Estate Plans.

You're Unique, So Your Plan Should Be Too.

We listen carefully to what you need. We work closely with you to create a strategy that effectively protects your assets and ensures the future well-being of your family. With our guidance, we can help you develop and maintain family privacy and fulfillment of your your wishes.

Effective Trusts & Estate Planning Services

A trust may offer you a variety of advantages, such as:

- Avoiding Probate

- Protecting Adult Children from their Potential Mistakes

- Minimizing or Avoiding Tax Consequences

- Keeping Financial Information Private

- Setting Money Aside for Your Children and Grand Children

- Setting Aside Money for Potential Disability or Long-Term Care

- Assisting with Supplemental Needs or Special Needs

- Obtaining Medicaid for yourself or a loved one

Types Of Trusts

- Revocable Living Trust

- Living Trust

- Joint Trust

- Spendthrift Trust

- Irrevocable Trust

- Medicaid Trust

- Land Trust

- Testamentary Trust

Are Estate Plans Necessary For Everybody?

Links and Resources

There are lots of misconceptions about estate planning, and any one of them can result in costly mistakes. Understanding who needs an estate plan and what it should cover is key to creating a plan that is right for you. A properly crafted estate plan allows you, while you are still living, to ensure that…

What will happen to your estate if your primary beneficiary does not survive you? If your will does not name an alternate beneficiary, your estate will be divided according to state law. The way the state divides your estate may not agree with your wishes. Your money may go to someone you don’t like or…

Sometimes homes and portfolios lose value or income and investments increase significantly. If this is the case for you, do you need to change your will? If your finances have changed markedly since you wrote your will, you should check your estate plan to see if you need to make any changes. If your will…

It is a very good idea to create advance directives in order to plan for the possibility that you may one day be unable to make your own medical decisions. In doing so, there can be confusion about the difference between a living will and a “do-not-resuscitate” order (DNR). While both these documents are advance…

Legendary singer Aretha Franklin was thought to have died without a will, but the recent discovery of handwritten documents in her home is calling that into question. A representative of her estate has asked a Michigan probate court to determine if any of the documents could be considered a valid will. When Franklin died August…

Imagine if tomorrow you were in a car accident or overcome by an illness and unable to communicate… What would your family do? I have sat on the edge of too many hospital and/or rehab beds dealing with distraught family members. You must have someone (with alternates) to call your insurance company, write checks, pay…

So much is being said in the news about dementia that I thought we should discuss why being occasionally forgetful is not such a concern. To the contrary, our memory may not always be so important. A recent article explains how forgetting is actually useful. By forgetting information that is stale, we are enabling ourselves…

Social Security survivor’s benefits provide a safety net to widows and widowers. But to get the most out of the benefit, you need to know the right time to claim. While you can claim survivor’s benefits as early as age 60, if you claim benefits before your full retirement age, your benefits will be permanently…

Medicare covers preventative care services, including an annual wellness visit. But confusing a wellness visit with a physical could be very costly. As part of the Affordable Care Act, Medicare beneficiaries receive a free annual wellness visit. At this visit, your doctor, nurse practitioner or physician assistant will generally do the following: Ask you to…

The number of older Americans with student loan debt – either theirs or someone else’s — is growing. Sadly, learning how to deal with this debt is now a fact of life for many seniors heading into retirement. According to a study by the Consumer Financial Protection Bureau, the number of older borrowers increased by…