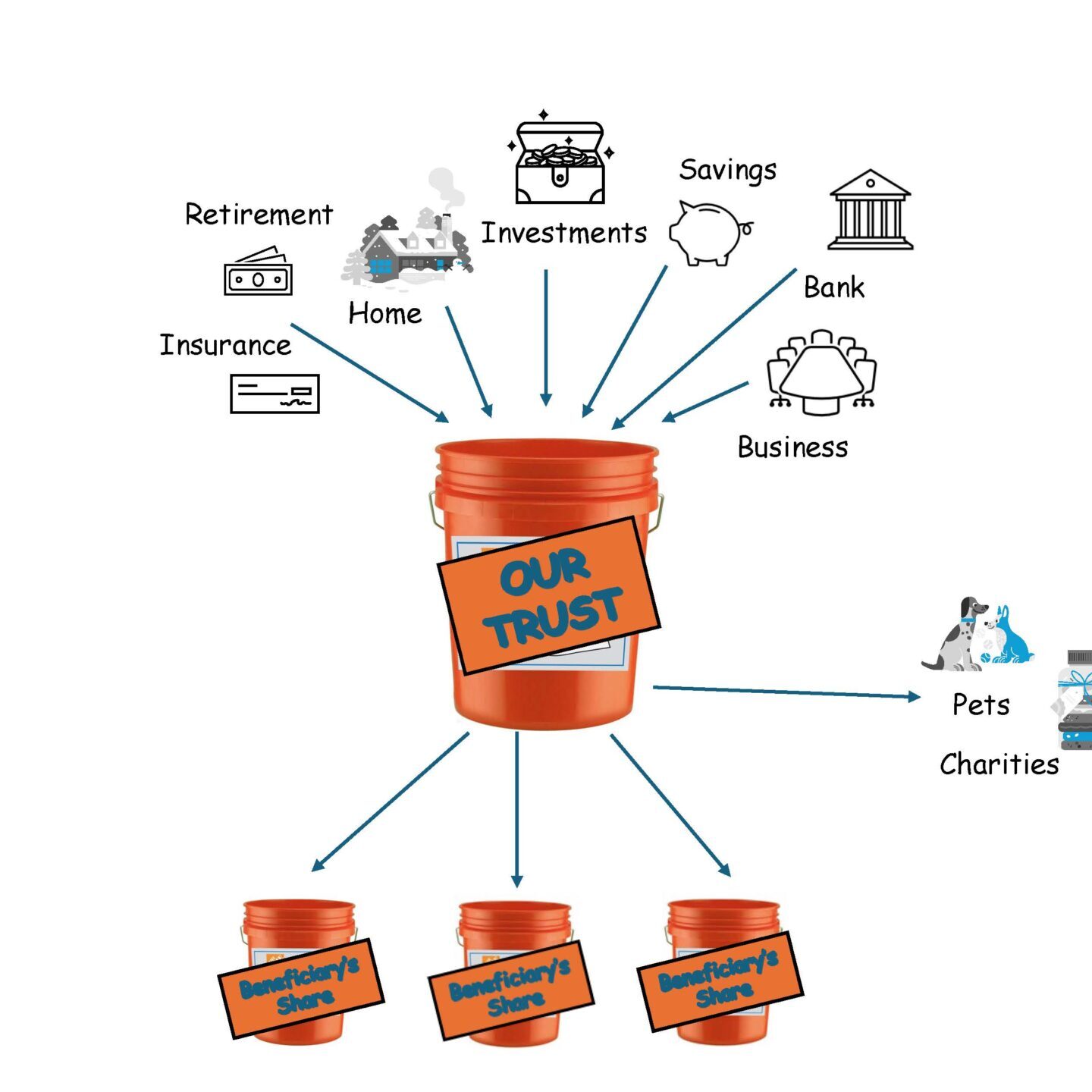

Trusts and Your Estate Plan

How We Can Help

We help create your Wills, Trusts and and comprehensive Estate Planning solutions tailored to your specific needs and goals. Our dedicated team is here to support you in developing personalized Living Wills, Powers of Attorney, Health Care Directives, and robust Estate Plans.

You're Unique, So Your Plan Should Be Too.

We listen carefully to what you need. We work closely with you to create a strategy that effectively protects your assets and ensures the future well-being of your family. With our guidance, we can help you develop and maintain family privacy and fulfillment of your your wishes.

Effective Trusts & Estate Planning Services

A trust may offer you a variety of advantages, such as:

- Avoiding Probate

- Protecting Adult Children from their Potential Mistakes

- Minimizing or Avoiding Tax Consequences

- Keeping Financial Information Private

- Setting Money Aside for Your Children and Grand Children

- Setting Aside Money for Potential Disability or Long-Term Care

- Assisting with Supplemental Needs or Special Needs

- Obtaining Medicaid for yourself or a loved one

Types Of Trusts

- Revocable Living Trust

- Living Trust

- Joint Trust

- Spendthrift Trust

- Irrevocable Trust

- Medicaid Trust

- Land Trust

- Testamentary Trust

Are Estate Plans Necessary For Everybody?

Links and Resources

As part of its response to the coronavirus pandemic, the federal government is broadly expanding coverage of Medicare telehealth services to beneficiaries and relaxing HIPAA enforcement. This will give doctors the ability to provide more services to patients remotely.

Many movies and television shows have a scene where a family gathers around a big table after a relative has died to listen to the reading of the will. While this makes for a dramatic scene, one that may have been more common when literacy rates were lower, it doesn’t usually happen this way in the modern world.

Unfortunately, this global health crisis can affect all aspects of your life. You should make sure you have these essential documents in place to protect yourself and your family

If you have a loved one in a nursing home, read how to ensure your loved one remains healthy.

Computer Virus Scams and Fake Cures – How to protect yourself during this epidemic.

Now is the time to make sure you are protected if you are quarantined or if you get sick! You will rest easier if your basic estate planning is done. But everyone should have these three basic documents, regardless of their wealth or health.

A durable power of attorney (POA) allows the person creating the POA, called the “principal,” to name a trusted agent who can act on his behalf in almost any situation. But because of the risk of abuse, many banks will scrutinize a POA carefully before allowing the agent to act on the principal’s behalf, and…

Trusts can be useful tools to pass assets to the next generation, protect your assets, save on estate taxes, or set aside money for a family member with special needs. The question I hear most often regarding trusts is “What is the difference between a Revocable Living Trust and an Irrevocable Trust.” Although both are…

1: When should you enroll in Part B? The magic age is 65! Even if you haven’t retired yet, you need to sign up during a seven-month initial enrollment period, which begins three months before you turn 65 and concludes three months after your birthday month. An exception allowing the delay of enrollment is if…

Inheriting property from your parents is either a blessing or a burden — or a little bit of both. Figuring out what to do with the property can be overwhelming, so it is good to carefully think through all of your choices. There are three main options when you inherit property: move in, sell, or…