Trusts and Your Estate Plan

How We Can Help

We help create your Wills, Trusts and and comprehensive Estate Planning solutions tailored to your specific needs and goals. Our dedicated team is here to support you in developing personalized Living Wills, Powers of Attorney, Health Care Directives, and robust Estate Plans.

You're Unique, So Your Plan Should Be Too.

We listen carefully to what you need. We work closely with you to create a strategy that effectively protects your assets and ensures the future well-being of your family. With our guidance, we can help you develop and maintain family privacy and fulfillment of your your wishes.

Effective Trusts & Estate Planning Services

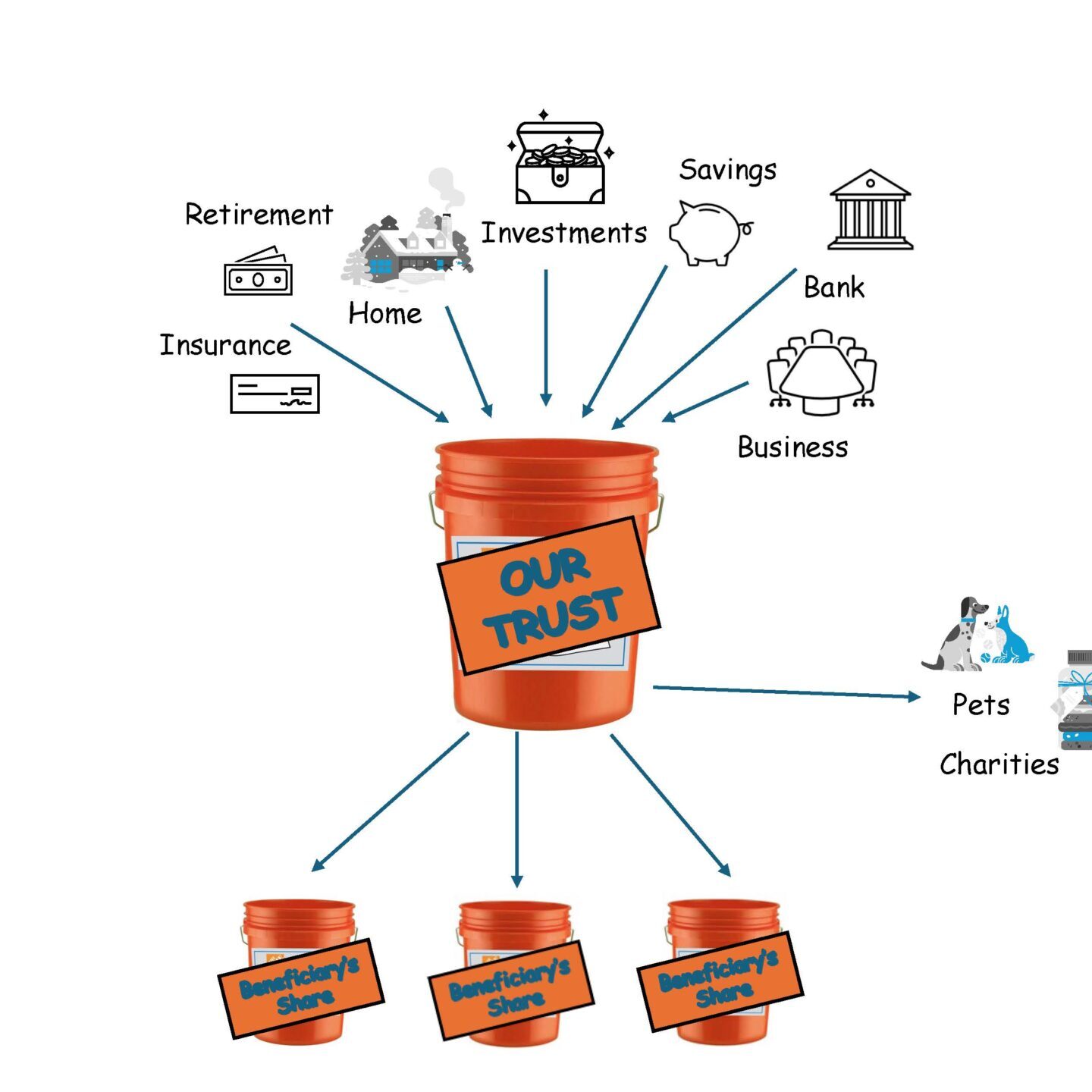

A trust may offer you a variety of advantages, such as:

- Avoiding Probate

- Protecting Adult Children from their Potential Mistakes

- Minimizing or Avoiding Tax Consequences

- Keeping Financial Information Private

- Setting Money Aside for Your Children and Grand Children

- Setting Aside Money for Potential Disability or Long-Term Care

- Assisting with Supplemental Needs or Special Needs

- Obtaining Medicaid for yourself or a loved one

Types Of Trusts

- Revocable Living Trust

- Living Trust

- Joint Trust

- Spendthrift Trust

- Irrevocable Trust

- Medicaid Trust

- Land Trust

- Testamentary Trust

Are Estate Plans Necessary For Everybody?

Links and Resources

When it comes to the vaccine for COVID-19, snowbirds are equal to the rest of us.

Senior visitors spending the winter in Florida, (including some just entering the state looking for the vaccine?) along with seniors who live in the state full-time and those with medical conditions, can get the vaccine here.

Although we really want a big family celebration where we can all celebrate the holidays together, that might not be the best idea right now. Many families are understandably trying to find other ways to be able to connect with our silver-aged loved ones during the holidays.

As part of the Coronavirus Aid, Relief and Economic Security (CARES) Act, Congress created a one-time $300 charitable deduction for people who do not itemize on their tax returns. To qualify, you must give cash (including paying by check or credit card) to a 501(c)(3) charity. G

Now is the annual opportunity to change medicare coverage. From Oct. 15 until Dec. 7, enrollees can shop Medicare’s marketplace for the prescription drug and Advantage plans offered by commercial insurance companies. They can also switch between fee-for-service original Medicare and Advantage.

And they will have plenty of choices: Next year, the typical Medicare enrollee will be able to choose from 57 Medicare prescription or Advantage plans that include drug coverage, according to the Kaiser Family Foundation.

Many entrepreneurs are successfully navigating new opportunities in serving their own peers.

Specifically, the article discusses the new career of “Patient Advocates” for the Elderly who are helping the adult or “sandwich generation” children navigate the complex and, sometimes horrific, medical system.

Estate planning is not just for the wealthy, it is something every adult should do. Estate planning can help you accomplish any number of goals, including appointing guardians for minor children, choosing healthcare agents to make decisions for you should you become ill, minimizing taxes so you can pass more wealth onto your family members, and stating how and to whom you would like to pass your estate on to when you pass away.

An organization called Hogeweykh is spreading the initiative to support all elderly individuals in living their best lives “with and despite their limitations due to dementia” with their care concept.

My goal of a client centered law practice of Estate Planning, Elder Law, Probate… philosophy is premised on empathy first and foremost, the ability to empathize with someone who has lived experiences different from mine.

Estate planning is just as important for single people as it is for couples and families. Estate planning allows you to ensure that your property will go to the people you want, in the way you want, and when you want. If you do not have an estate plan, the state will decide who gets your property and who will make decisions for you should you become incapacitated, and these aren’t necessarily the choices you would have wanted. Contact me at 954-515-0101 to find out what estate planning documents you need to assure your wishes will be carried out and those you care about will be protected.

The limited liability company (LLC) is a popular business structure for new businesses, but what does it really mean to own an LLC? It can provide unique opportunities to customize business ownership to fit your specific needs and circumstances. Here is what you should know about LLC ownership.