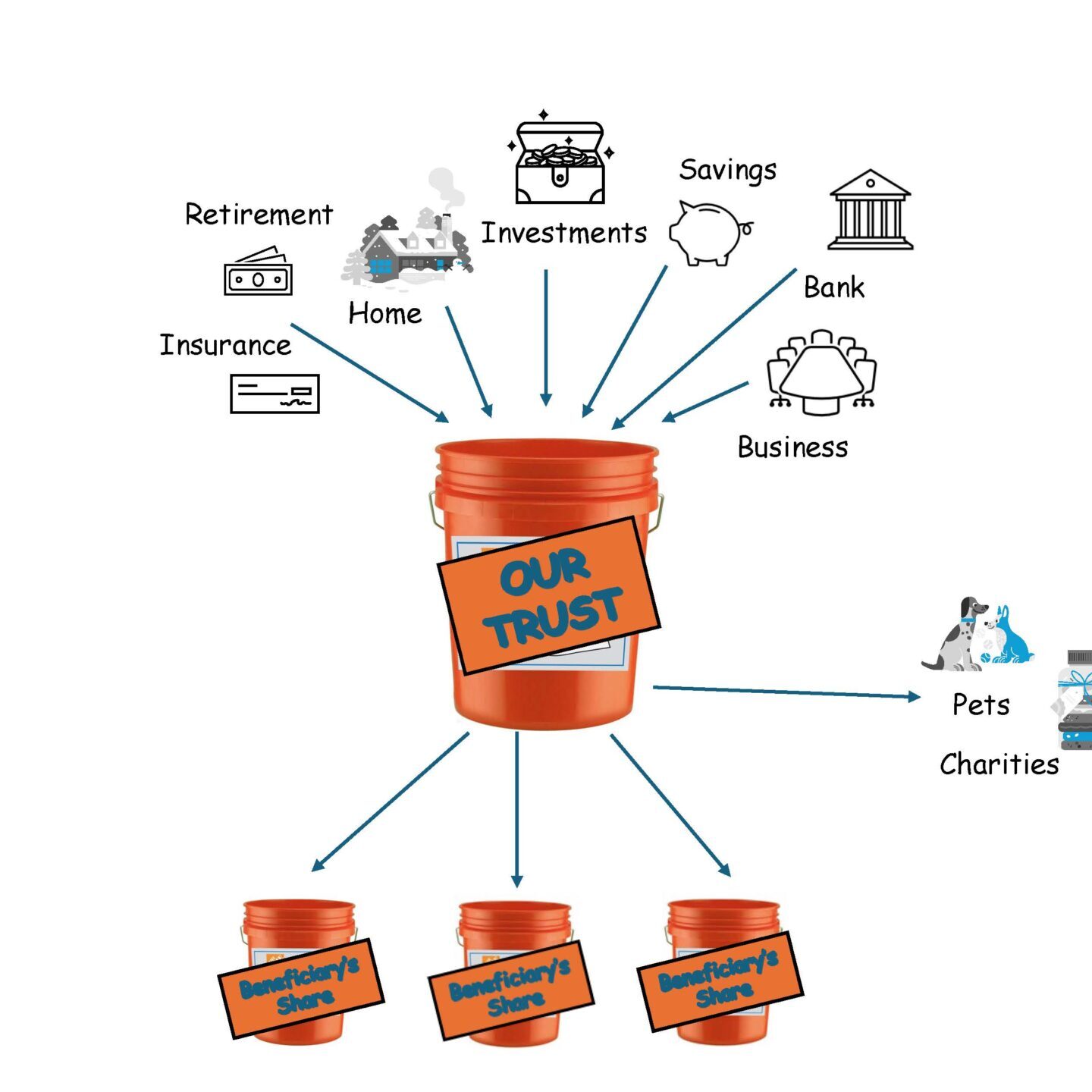

Trusts and Your Estate Plan

How We Can Help

We help create your Wills, Trusts and and comprehensive Estate Planning solutions tailored to your specific needs and goals. Our dedicated team is here to support you in developing personalized Living Wills, Powers of Attorney, Health Care Directives, and robust Estate Plans.

You're Unique, So Your Plan Should Be Too.

We listen carefully to what you need. We work closely with you to create a strategy that effectively protects your assets and ensures the future well-being of your family. With our guidance, we can help you develop and maintain family privacy and fulfillment of your your wishes.

Effective Trusts & Estate Planning Services

A trust may offer you a variety of advantages, such as:

- Avoiding Probate

- Protecting Adult Children from their Potential Mistakes

- Minimizing or Avoiding Tax Consequences

- Keeping Financial Information Private

- Setting Money Aside for Your Children and Grand Children

- Setting Aside Money for Potential Disability or Long-Term Care

- Assisting with Supplemental Needs or Special Needs

- Obtaining Medicaid for yourself or a loved one

Types Of Trusts

- Revocable Living Trust

- Living Trust

- Joint Trust

- Spendthrift Trust

- Irrevocable Trust

- Medicaid Trust

- Land Trust

- Testamentary Trust

Are Estate Plans Necessary For Everybody?

Links and Resources

Every holiday season, there’s at least one gift that quietly ends up in the closet… or the re-gift pile. Maybe it’s the sweater that itches, the kitchen gadget you’ll never use, or the office White Elephant disaster that keeps resurfacing. National Regifting Day (the Thursday before Christmas) is a lighthearted reminder that sometimes it’s okay…

Holiday Fun Facts (That Double as Estate Planning Conversation Starters) Picture this: the house is decorated, the food is in the oven, and the family is finally under one roof. It’s the perfect time for… an argument about who gets Grandma’s china. Let’s avoid that. You don’t have to bring up wills and trusts over…

Business Owner Retirement: Employee-Based Succession Planning: MBOs and ESOPs Explained After years of pouring your energy, passion, and grit into building a successful business, the idea of handing over the reins can feel both thrilling and a little nerve-racking. But what if your exit strategy could reward the very people who helped you get here?…

Featured September 2025 Article | Our City Weston Magazine Being featured by Our City is a meaningful nod to what matters most here: clear, customized planning. At Andrea L. Jakob, PA, we go beyond documents—designing wills, trusts, powers of attorney, and deeds that protect assets, preserve harmony, and prepare the next generation. Our streamlined process…

National Stepfamily Day: Planning With Blended Families in Mind (September 16) Happy National Stepfamily Day to everyone who celebrates! With family structures evolving, there’s a good chance you’re part of a step/blended/“bonus” family—or you love someone who is—making September 16 a perfect time to celebrate and to plan. At its heart, this day honors second…

Most people think of probate (the process of collecting, managing, and distributing a deceased person’s money and property) as a private process. However, because probate involves the court system, most filings become a matter of public record. That means your nosy neighbor Nellie can simply go to the courthouse or hop online to learn all…

A Public Life, A Private Death. Private Estate Plan The passing of actor Val Kilmer in April 2025 brings attention to estate planning issues that affect far more than just celebrities. While Kilmer was a public figure, the challenges his estate faced—such as managing real estate in multiple states, handling digital assets, and using charitable…

“You can have an ex-wife, but never an ex-child” George Foreman lived a rags-to-riches tale of pure Americana: Olympic gold medalist, heavyweight boxing champion, ordained minister, global pitchman, and father to a dozen children. Unlike many celebrities, Foreman was considered relatable and connected to his audience. But beyond the fortune and fame, George’s life reminds us…

From Game Shows to Estate Plans: Insights we can Learn from Regis Regis Philbin, the Guinness World Record holder for the most hours on US television, was a familiar face in millions of homes for decades. By the time he retired from his show Live with Regis and Kelly in 2011, he had spent more than 16,740…

Etsy has grown from a small marketplace for handmade goods to a global e-commerce powerhouse, with millions of sellers—many of whom rely on it for income. But while sellers pour their time and creativity into building their shops, few consider what would happen if they could no longer manage their store due to illness, disability,…